How to Locate Your Property’s Assessed Valuation

To determine the impact of a potential bond measure on your property taxes, obtain a copy of your Monterey County Property Tax Statement. If you do not have a copy of the property tax statement, please follow the steps listed below.

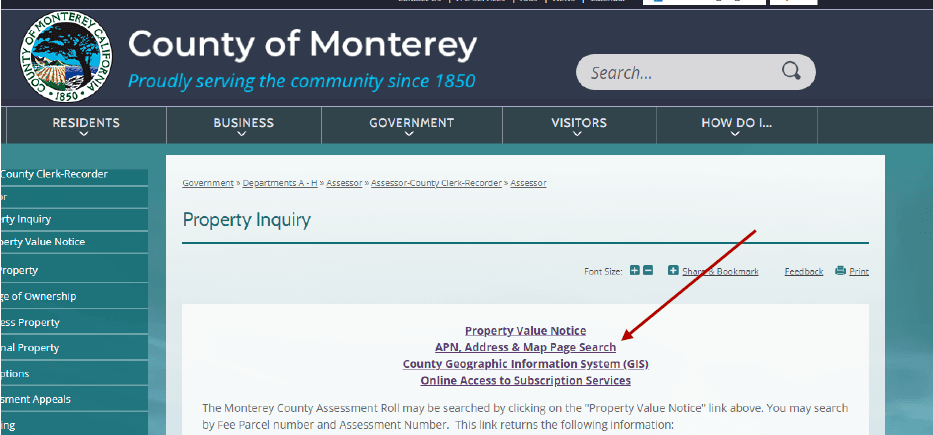

- Go to CountyofMonterey.gov (link opens in a new window), select "Government" > "Departments A - H" > "Assessor" > "Assessor" (Left side of page) > "Property Inquiry". On this page, select "APN, Address & Map Page Search" (link opens in a new window).

- Select APN, Address, & Map Page Search.

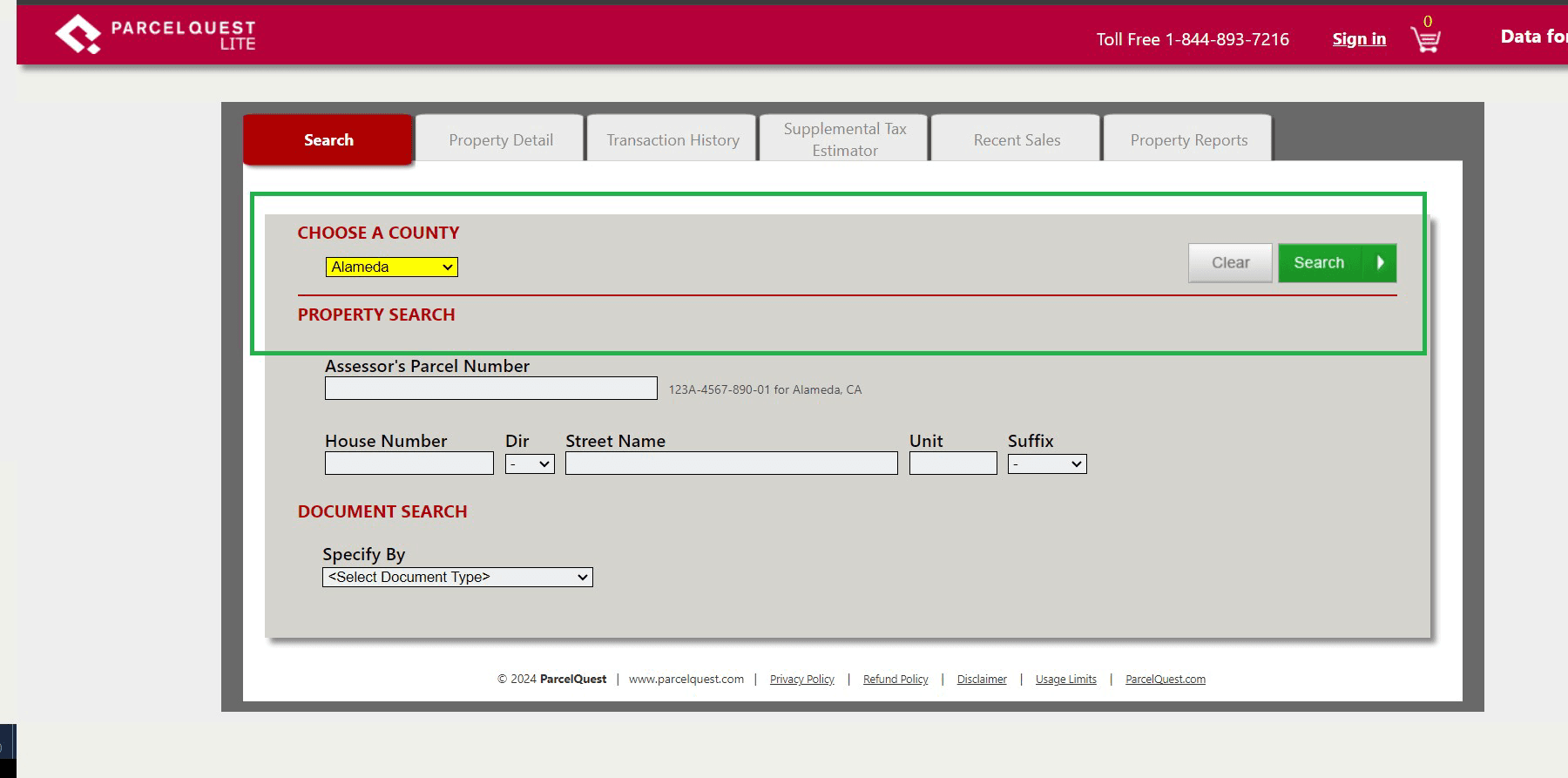

- This link should take you to the screen presented below.

- If prompted to select a County under the "Choose a County" drop-down menu, select Monterey.

- Type in your house number and street name and click Search.

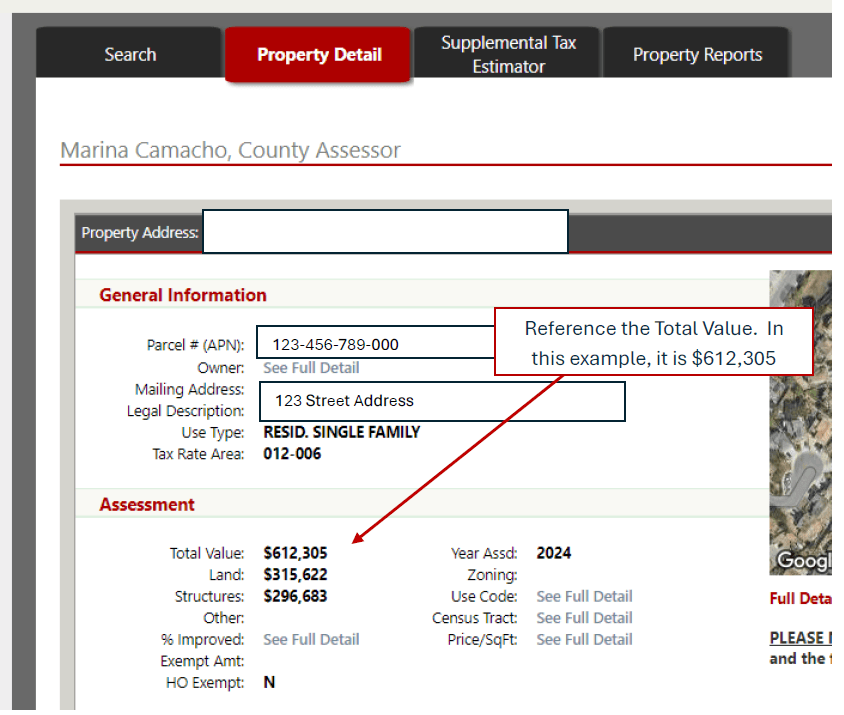

- A copy of your property statement with the assessed valuation will be displayed. An excerpt is provided for reference.

- Reference the Total Value when using the Sample Bond Measure Calculator to estimate the impact of a bond measure on your property tax bill.